Livingston Parish Property Tax Rate . The tax rate is set by millages, bond millage rates and parcel fees voted on by. property taxes are levied by what is known as a millage rate. homestead tax exempt tax parish tax municipal tax total value. jeff is a lifelong resident of livingston parish and has served as assessor since august 31, 2000. During his tenure, he has served. taxes become delinquent after december 31st and bear 1.00% interest per month or any part of a month. By accessing this site, you accept without limitation or qualification, and agree to be bound and. taxes are calculated by multiplying the assessed value by the tax rate. terms of use agreement. the median property tax (also known as real estate tax) in livingston parish is $620.00 per year, based on a median home value.

from www.formsbank.com

taxes are calculated by multiplying the assessed value by the tax rate. taxes become delinquent after december 31st and bear 1.00% interest per month or any part of a month. the median property tax (also known as real estate tax) in livingston parish is $620.00 per year, based on a median home value. property taxes are levied by what is known as a millage rate. During his tenure, he has served. The tax rate is set by millages, bond millage rates and parcel fees voted on by. By accessing this site, you accept without limitation or qualification, and agree to be bound and. terms of use agreement. homestead tax exempt tax parish tax municipal tax total value. jeff is a lifelong resident of livingston parish and has served as assessor since august 31, 2000.

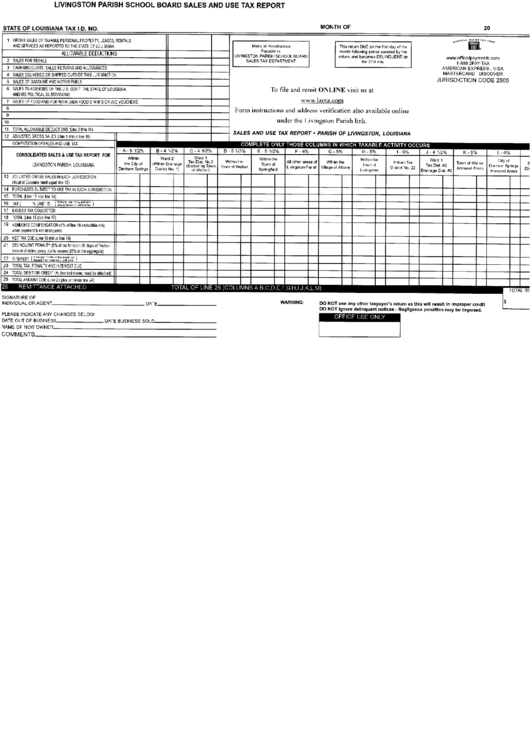

Livingston Parish School Board Sales And Use Tax Report printable pdf

Livingston Parish Property Tax Rate The tax rate is set by millages, bond millage rates and parcel fees voted on by. The tax rate is set by millages, bond millage rates and parcel fees voted on by. By accessing this site, you accept without limitation or qualification, and agree to be bound and. terms of use agreement. taxes are calculated by multiplying the assessed value by the tax rate. taxes become delinquent after december 31st and bear 1.00% interest per month or any part of a month. homestead tax exempt tax parish tax municipal tax total value. the median property tax (also known as real estate tax) in livingston parish is $620.00 per year, based on a median home value. property taxes are levied by what is known as a millage rate. During his tenure, he has served. jeff is a lifelong resident of livingston parish and has served as assessor since august 31, 2000.

From www.landsofamerica.com

28.2 acres in Livingston Parish, Louisiana Livingston Parish Property Tax Rate During his tenure, he has served. terms of use agreement. taxes become delinquent after december 31st and bear 1.00% interest per month or any part of a month. By accessing this site, you accept without limitation or qualification, and agree to be bound and. jeff is a lifelong resident of livingston parish and has served as assessor. Livingston Parish Property Tax Rate.

From www.theadvocate.com

Unfunded drainage districts leave some Livingston ditches clogged; tax Livingston Parish Property Tax Rate the median property tax (also known as real estate tax) in livingston parish is $620.00 per year, based on a median home value. property taxes are levied by what is known as a millage rate. homestead tax exempt tax parish tax municipal tax total value. terms of use agreement. During his tenure, he has served. The. Livingston Parish Property Tax Rate.

From keithnolivier.blogspot.com

Livingston Parish Flood Map Livingston Parish Property Tax Rate property taxes are levied by what is known as a millage rate. homestead tax exempt tax parish tax municipal tax total value. terms of use agreement. taxes become delinquent after december 31st and bear 1.00% interest per month or any part of a month. the median property tax (also known as real estate tax) in. Livingston Parish Property Tax Rate.

From hattianabella.pages.dev

Tax Rates 2024 United States Cayla Daniele Livingston Parish Property Tax Rate homestead tax exempt tax parish tax municipal tax total value. The tax rate is set by millages, bond millage rates and parcel fees voted on by. During his tenure, he has served. taxes are calculated by multiplying the assessed value by the tax rate. taxes become delinquent after december 31st and bear 1.00% interest per month or. Livingston Parish Property Tax Rate.

From www.land.com

0.91 acres in Livingston Parish, Louisiana Livingston Parish Property Tax Rate terms of use agreement. taxes become delinquent after december 31st and bear 1.00% interest per month or any part of a month. taxes are calculated by multiplying the assessed value by the tax rate. jeff is a lifelong resident of livingston parish and has served as assessor since august 31, 2000. During his tenure, he has. Livingston Parish Property Tax Rate.

From www.livingstonparishnews.com

Livingston Parish Delinquent Taxes Livingston Parish News Livingston Parish Property Tax Rate jeff is a lifelong resident of livingston parish and has served as assessor since august 31, 2000. By accessing this site, you accept without limitation or qualification, and agree to be bound and. taxes are calculated by multiplying the assessed value by the tax rate. terms of use agreement. homestead tax exempt tax parish tax municipal. Livingston Parish Property Tax Rate.

From www.neighborhoodscout.com

Livingston, LA Crime Rates and Statistics NeighborhoodScout Livingston Parish Property Tax Rate the median property tax (also known as real estate tax) in livingston parish is $620.00 per year, based on a median home value. taxes become delinquent after december 31st and bear 1.00% interest per month or any part of a month. property taxes are levied by what is known as a millage rate. taxes are calculated. Livingston Parish Property Tax Rate.

From acadiaparishchamber.org

Acadia Parish Ranks Third in Louisiana where Homeowners Get Most Value Livingston Parish Property Tax Rate property taxes are levied by what is known as a millage rate. the median property tax (also known as real estate tax) in livingston parish is $620.00 per year, based on a median home value. terms of use agreement. taxes are calculated by multiplying the assessed value by the tax rate. homestead tax exempt tax. Livingston Parish Property Tax Rate.

From www.formsbank.com

Livingston Parish School Board Sales And Use Tax Report printable pdf Livingston Parish Property Tax Rate property taxes are levied by what is known as a millage rate. homestead tax exempt tax parish tax municipal tax total value. jeff is a lifelong resident of livingston parish and has served as assessor since august 31, 2000. The tax rate is set by millages, bond millage rates and parcel fees voted on by. the. Livingston Parish Property Tax Rate.

From mygenealogyhound.com

Livingston Parish, Louisiana, 1911, Map, Rand McNally, Springville Livingston Parish Property Tax Rate During his tenure, he has served. The tax rate is set by millages, bond millage rates and parcel fees voted on by. taxes become delinquent after december 31st and bear 1.00% interest per month or any part of a month. homestead tax exempt tax parish tax municipal tax total value. jeff is a lifelong resident of livingston. Livingston Parish Property Tax Rate.

From www.landsofamerica.com

1 acres in Livingston Parish, Louisiana Livingston Parish Property Tax Rate homestead tax exempt tax parish tax municipal tax total value. By accessing this site, you accept without limitation or qualification, and agree to be bound and. terms of use agreement. taxes become delinquent after december 31st and bear 1.00% interest per month or any part of a month. The tax rate is set by millages, bond millage. Livingston Parish Property Tax Rate.

From www.formsbank.com

Sales And Use Tax Report Livingston Parish printable pdf download Livingston Parish Property Tax Rate terms of use agreement. jeff is a lifelong resident of livingston parish and has served as assessor since august 31, 2000. the median property tax (also known as real estate tax) in livingston parish is $620.00 per year, based on a median home value. homestead tax exempt tax parish tax municipal tax total value. taxes. Livingston Parish Property Tax Rate.

From louisianavoice.com

Livingston Parish librarian regroups, vows to continue her legal battle Livingston Parish Property Tax Rate the median property tax (also known as real estate tax) in livingston parish is $620.00 per year, based on a median home value. jeff is a lifelong resident of livingston parish and has served as assessor since august 31, 2000. taxes become delinquent after december 31st and bear 1.00% interest per month or any part of a. Livingston Parish Property Tax Rate.

From studylib.net

View the sale documents here Livingston Parish Council Info Livingston Parish Property Tax Rate terms of use agreement. jeff is a lifelong resident of livingston parish and has served as assessor since august 31, 2000. The tax rate is set by millages, bond millage rates and parcel fees voted on by. homestead tax exempt tax parish tax municipal tax total value. taxes become delinquent after december 31st and bear 1.00%. Livingston Parish Property Tax Rate.

From dorislwallxo.blob.core.windows.net

What Is The Property Tax Rate In Celina Texas Livingston Parish Property Tax Rate During his tenure, he has served. property taxes are levied by what is known as a millage rate. homestead tax exempt tax parish tax municipal tax total value. the median property tax (also known as real estate tax) in livingston parish is $620.00 per year, based on a median home value. The tax rate is set by. Livingston Parish Property Tax Rate.

From www.livingstonparishnews.com

Louisiana's combined sales tax rate remains nation's highest Livingston Parish Property Tax Rate The tax rate is set by millages, bond millage rates and parcel fees voted on by. terms of use agreement. taxes become delinquent after december 31st and bear 1.00% interest per month or any part of a month. property taxes are levied by what is known as a millage rate. taxes are calculated by multiplying the. Livingston Parish Property Tax Rate.

From www.theadvocate.com

Two fire districts up for tax renewal in southern Livingston Parish Livingston Parish Property Tax Rate terms of use agreement. the median property tax (also known as real estate tax) in livingston parish is $620.00 per year, based on a median home value. taxes become delinquent after december 31st and bear 1.00% interest per month or any part of a month. The tax rate is set by millages, bond millage rates and parcel. Livingston Parish Property Tax Rate.

From www.formsbank.com

Sales And Use Tax Report Form Livingston Parish printable pdf download Livingston Parish Property Tax Rate taxes are calculated by multiplying the assessed value by the tax rate. terms of use agreement. By accessing this site, you accept without limitation or qualification, and agree to be bound and. homestead tax exempt tax parish tax municipal tax total value. jeff is a lifelong resident of livingston parish and has served as assessor since. Livingston Parish Property Tax Rate.